The content material on this article is for basic information and schooling purposes only and should not be construed as legal or tax advice. Stripe doesn’t warrant or assure the accurateness, completeness, adequacy, or currency of the knowledge in the article. You should search the advice of a reliable attorney or accountant licensed to follow in your jurisdiction for recommendation on your specific scenario. Baremetrics integrates immediately along with your fee processor, so information about your prospects is mechanically piped into the Baremetrics dashboards.

Accrual accounting is a method of economic reporting by which transactions are recorded when they’re incurred, not when the money is exchanged. This method allows for a extra correct reflection of a company’s monetary activities, providing a greater understanding of the company’s overall monetary well being. An insurance coverage supplier receives payment in January for coverage that runs via December. That payment is recorded as unearned revenue and then shifted into revenue month by month as protection is offered. You’ll see an example of the 2 journal entries your business might need to create beneath when recording unearned revenue. Taking the earlier instance from above, Beeker’s Thriller Packing Containers will record its transactions with James of their accounting journals.

This section will discuss essential adjustments and handling overstatements and understatements. Unearned revenue has a direct impact on a company’s income statement as well. As the corporate delivers the products or provides the companies, it may possibly recognize the corresponding income.

Generally you are paid for goods or providers earlier than you present these services to your customer. In this article, I will go over the ins and outs of unearned income, when you must acknowledge revenue, and why it is a liability. Don’t worry should you don’t know much about accounting, as I’ll illustrate every thing with some examples. Distinguishing between deferred (unearned) and acknowledged (earned) revenue is crucial for transparent financial reporting and compliance with accounting requirements. For example, let’s say a landscaping firm expenses its prospects $200 for five lawn-cutting providers and its clients are required to prepay the $200 upfront. As a result of this prepayment, the landscaping firm now has a legal responsibility to its prospects that is equal to the income earned from the precise efficiency of the companies in query.

Hence, the unearned revenue account represents the duty that the corporate owes to its prospects. The amount in this account shall be transferred to revenue when the corporate fulfills its obligation by delivering goods or providing companies to its clients. Beneath the accrual foundation of accounting, revenue should solely be recognized when it’s earned, not when the fee is obtained.

Definition And Example Of Unearned Revenue

- Classic examples include lease funds made prematurely, pay as you go insurance coverage, legal retainers, airline tickets, prepayment for newspaper subscriptions, and annual prepayment for the use of software program.

- Frequently reviewing and adjusting for unearned income permits for higher financial decision-making and reporting.

- Software-as-a-Service (SaaS) corporations frequently receive prepayments for annual subscriptions.

- In subscription-based industries with software services, pay as you go service agreements, and professional retainers, deferred income is normally a significant part of a company’s operations.

Then, you will at all times know how a lot money you’ve readily available, which shoppers have paid, and who you still owe services to. Mainly, ASC 606 stipulates that you simply acknowledge internally and for tax functions income as you carry out the obligations of your gross sales contract. Relying on the scale of your company, its ownership profile, and any local regulatory requirements, you could want to use the accrual accounting system. Trust is needed as a result of it’s rare for cash and goods to change hands concurrently.

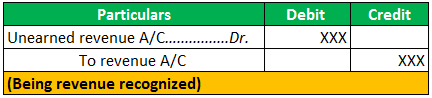

The accounting for deferred revenue includes a debit to the money unearned revenue or accounts receivable account and a credit to the deferred revenue legal responsibility account. This reflects the increase in cash or receivables and the corresponding obligation to deliver goods or companies. As a liability, deferred revenue reflects an obligation to ship a product or service.

Subscribe To Taxfyle

If not refunded, the amount might have to be reversed, which may create a legal or accounting concern. Baremetrics is a enterprise metrics device that provides 26 metrics about your business, such as MRR, ARR, LTV, whole prospects, and extra. First, since you may have obtained money out of your clients, it appears as an asset in your money and money equivalents.

Income Assertion Correlations

When clients prepay premiums—like an annual auto insurance policy from State Farm Insurance—the insurer initially classifies funds as deferred income. Income recognition then happens steadily, each month corresponding to the coverage provided. By employing effective cash administration strategies and strong threat assessment techniques, firms can navigate the intricacies of unearned income administration. Adopting these practices will promote financial stability and progress whereas maintaining buyer satisfaction and belief. Throughout this course of, firms must adhere to authorities and accounting commonplace reporting procedures. This adherence ensures compliance with monetary regulations and helps maintain the accuracy and integrity of the company’s monetary reporting.

These prepayments assist corporations to higher their money flows and produce the services or products with lesser trouble. If Mexico prepares its annual monetary statements on December 31 annually, it should report an unearned income legal responsibility of $25,000 in its year-end balance https://www.quickbooks-payroll.org/ sheet. When the corporate will deliver items to the buyer on January 15, 2022, it will get rid of the legal responsibility and acknowledge a revenue in its accounting information on that date. As Soon As the services or products has been delivered, the deferred revenue is recognized as earned, transitioning from a legal responsibility on the stability sheet to revenue on the earnings assertion. As the company performs the service or delivers the products, it deducts the suitable quantity from the unearned income account.